Chapters of the article

- VAT registration

- Advantages and disadvantages of VAT payment

- When to register for VAT voluntarily?

- How to register for VAT?

VAT registration

Since last year, the threshold for compulsory VAT registration has been CZK 2 million. The increase of the limit to CZK 2 million was justified by the high administrative burden, which the government has undertaken to reduce. You must become a VAT payer if you have a turnover of more than CZK 2 million for the past 12 consecutive calendar months. This is something to watch out for because it is not really tied to calendar years.

However, you can also become a VAT payer voluntarily if your turnover is significantly lower. However, it is advisable to consult a lawyer or accountant about such a move. There are a number of obligations associated with it, which you have to keep in mind. In this case, you can register for VAT as soon as you start your business or at any time during the course of your business.

For these purposes, turnover is defined as the aggregate of payments made, net of tax, for transactions with a place of supply in the country. It does not, however, include transactions that have a place of supply outside the country and transactions that are exempt from tax without the right to deduct tax.

Once you have reached the limit, you must apply for registration for payment within 15 days of the end of the calendar month in which the turnover exceeded the limit.

Are you solving a similar problem?

Are you facing a legal problem that is beyond your capabilities and does not fall under any of our legal services?

We will assess your case and draft a proposal for legal services to resolve it within 24 hours. If you then decide to entrust its solution in our hands, you have the drafting of the proposal free of charge.

I want to consult

- When you order, you know what you will get and how much it will cost.

- We handle everything online or in person at one of our 6 offices.

- We handle 8 out of 10 requests within 2 working days.

- We have specialists for every field of law.

Tip for article

Tip: Being self-employed involves a certain amount of administrative burden in the form of levies, payments and tax returns. What does all this entail and when is a flat-rate tax worthwhile instead? We have addressed this in our separate article.

Advantages and disadvantages of paying VAT

The obligation to register brings incomparably more obligations for entrepreneurs. This is the main reason why voluntary registration is not recommended. Unless there is a special reason for it, for example, in the form of clients looking for taxpayers. However, most entrepreneurs have no choice but to register for VAT. What are the advantages and disadvantages of this step?

Advantages of paying VAT for entrepreneurs:

- Registering for VAT can increase the credibility of a sole trader as it is clear that they are not just a small business.

- Satisfaction can come, for example, in the form of orders from clients who specifically request VAT. For business in certain markets or on a larger scale, VAT registration may be essentially necessary.

- The ability to deduct VAT and save costs will also be pleasing. Businesses can deduct the VAT they pay on inputs (e.g. when purchasing materials or services for their business) from the VAT they charge to customers (VAT payers). This helps to reduce the overall cost of doing business. However, you can claim the deduction on your normal VAT return up to a maximum of 3 years after the transaction.

Disadvantages of paying VAT for businesses:

- Registering for VAT brings with it significantly more administrative requirements, such as more detailed double-entry bookkeeping and tax returns, and VAT-related administration in general. While the vast majority of self-employed persons can complete the tax return themselves, double-entry bookkeeping usually requires hiring someone who is proficient in this area. In addition, you are obliged to file a tax return regularly (monthly or quarterly) and submit an audit or summary report.

- If a business cannot deduct all the VAT paid, it can be a financial burden. They must also be careful to calculate correctly the VAT they charge to customers.

- Registering for VAT increases the risk of tax audits and possible penalties for incorrect bookkeeping or errors in tax returns.

When to volunteer to pay VAT?

Voluntary registration is usually opted for by those who have VAT payers among their long-term business partners. On the other hand, small domestic entrepreneurs who provide goods or services to non-VAT payers do not benefit from voluntary registration. It is also not worthwhile when entrepreneurs buy goods at the reduced rate but sell goods at the standard rate. However, if the situation is reversed, i.e. buying goods at the reduced rate and selling them at the standard rate, then an excess deduction arises and the state will refund the money.

So if you are still considering your registration, consider the advantages and disadvantages above. However, there are other factors that may also play a role in your decision.

For businesses planning to trade within or outside the EU, VAT registration can be advantageous. This is because non-payers of VAT can look suspicious and non-transparent and find it more difficult to establish business relationships. Taxpayers, on the other hand, are usually perceived as equal and trustworthy partners by representatives of foreign companies. Registration may be worthwhile for international taxation and customs purposes.

If your brand is growing rapidly and you can expect to reach the statutory limit very soon, it may be possible to prepare for registration earlier, hire or approach external accountants and register a little before the statutory obligation arises. This will avoid the sudden compulsory registration and the associated administrative burden that would arise once the limit is exceeded.

Businesses can better plan their cash flow and financial strategy in anticipation of VAT, rather than being surprised by the change once the mandatory limit is reached.

Tip for article

Tip: Starting a new business is a big challenge. You have a detailed vision, you may have a business and financial plan in place. However, few budding entrepreneurs and startups think about the legal side of business, which is often crucial to success. We’ll advise you on it in our separate article.

How do I apply for value added tax?

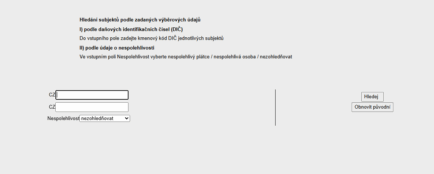

To register, simply fill in the online form and send it to the tax administration. It is available in the tax administration application under the Electronic Forms section.

It is advisable to attach attachments to the form to prove your turnover for the last twelve months. You should receive your VAT registration certificate within 15 days. However, registration must be authorised by the tax authorities. If you register voluntarily, you are not 100% sure that you will become a taxable person. However, do not wait for the certificate to be sent to you to fulfil your VAT obligations, as you could soon face penalties.

In some cases, officials will ask for more detailed information or documents to prove your economic activity. In particular, you should prepare contracts and invoices with suppliers or customers, bank statements and other documents.