Who is an unreliable payer and unreliable person

An unreliable taxpayer is a VAT payer who is in serious breach of his tax administration obligations. The institution was introduced by the VAT Act as of 1 January 2013 and its purpose is to protect VAT collection and to alert businesses to the increased risk of trading with such a person.

Typical reasons for granting unreliable taxpayer status are significant and persistent arrears and repeated non-compliance.

Are you solving a similar problem?

Not sure how to do your taxes properly so you don't get it wrong?

We can help you navigate the law, whether it’s dealing with a specific tax situation, preparing for an audit by the tax authority or defending yourself in court.

I want to consult

- When you order, you know what you will get and how much it will cost.

- We handle everything online or in person at one of our 6 offices.

- We handle 8 out of 10 requests within 2 working days.

- We have specialists for every field of law.

Unreliable person was introduced as of 1 July 2017. It refers to persons who are not VAT payers but have seriously violated their obligations related to VAT administration (typically identified persons, persons liable to tax before registration, etc.).

The aim is to maintain the information on unreliability even when the de-registration would otherwise have taken place. The status of unreliable person may arise by decision of the tax administration or directly by law – for example, when an unreliable taxpayer becomes an unreliable person after cancellation of registration.

The law does not explicitly provide for an official categorization of a reliable VAT payer. In practice, this only negatively indicates that the entity is not listed as unreliable. This can be verified in the VAT Register.

Why unreliable payers are dangerous as business partners

Doing business with an unreliable payer is risky primarily because of the liability for VAT. The VAT Act explicitly states that if you accept a supply from an unreliable payer, you may be liable for the tax that the supplier fails to pay. In practice, this means that the tax authorities can ask you to pay the unpaid tax instead of the supplier – over and above what you have already paid them in value.

The VAT liability arises where the supplier has not paid the tax and you, as the customer, knew or should have known and could have known that the non-payment would actually occur (this also applies to advances). This is particularly clear if the supplier is identified as an unreliable taxpayer in the register.

However, the law already presupposes such knowledge for certain warning signs: for example, when the transaction is a related party transaction, the price is suspiciously low without reasonable cause, the payment is made in cash to an account that is not published in the VAT register, part of the price is to be paid with a virtual asset (cryptocurrency), the cash payment exceeds the legal limit, or the fuel supplier is not listed as a registered distributor.

Frequently Asked Questions

When and how can I apply for cancellation of the unreliable payer/person status?

The earliest you can apply for redress is one year after the last relevant decision. The status will be revoked if there have been no serious breaches of the tax administration rules during this period. You can read more in our article.

What if only one member of the group is unreliable?

If an unreliable person or unreliable payer becomes a member of a group, the entire group becomes an unreliable payer.

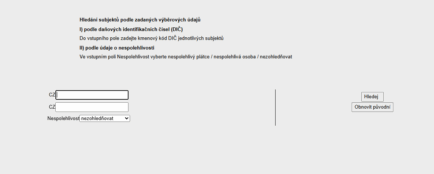

Where and how to verify the VAT payer (VAT number and VAT payer by VAT number)

If you are trying to find out who is liable for VAT, follow this procedure:

1) VAT register (MY taxes)

The My Taxes portal contains basic data on VAT entities and allows you to find the VAT payer by entering the VAT number. Here you can find out whether the entity is a taxable person, whether it is an unreliable VAT payer, what bank accounts it has published, the effective date of registration and the competent tax authority. This register is official and updated daily (usually between 0:00 and 0:10).

2) When you only know the VAT number: how to find out the VAT payer by VAT number in practice

The VAT register searches primarily by VAT number, but in everyday life you more often know the VAT number. The procedure is simple: first, use ARES (the Administrative Register of Economic Entities of the Ministry of Finance) to find the entity by registration number and then use its record to find the VAT number (if it has one). Then you check the VAT number in the VAT register. ARES is an information aggregator of public registers – great for quick identification of a company or self-employed person; however, the VAT Register is crucial for VAT information.

3) EU customers and suppliers: VIES

If you trade within the EU, check the validity of the VAT number in the European Commission’s VIES system to see if the trading partner is registered for VAT. The result has its own query ID number – we recommend you save it for checking.

Frequently Asked Questions

Is it possible to trace the history of published bank accounts?

Yes. The VAT register has an “Account History” button that displays accounts whose publication has been closed.

Can I find identified persons in the register?

Yes, the VAT Register also shows the identified persons.

How to safely pay an unreliable VAT payer

When you need to carry out a transaction but your partner is an unreliable taxpayer (or you feel otherwise liable), Czech law provides an effective tool called “special method of securing tax”. In practice, this means that you pay the amount of VAT directly to the supplier’s tax authority – and thus get out of the liability.

How to do it step by step:

- You pay into the supplier’s tax office bank account with the prefix 80039 (the so-called deposit account for securing the tax), adding the registration number of the relevant tax office and the bank code 0710 (CNB).

- You fill in the variable symbol = stem part of the VAT number of the provider of the taxable supply (without “CZ”).

- You fill in the specific symbol = stem part of the VAT number of the recipient (you).

- In the message to the recipient, enter the date of the taxable transaction in DD/MM/YYYYYY-P format or the date of receipt of the payment in DD/MM/YYYYYY-U format.

This procedure must be followed to ensure that your payment is attributable to the tax you are securing.

The accounts of the financial authorities (registry, IBAN) can be found in the official overview of the Czech Financial Service.

Also, do not forget to save evidence of the entire transaction (order, contract, tax document, verification outputs from the VAT Register or VIES, payment confirmation). In the event of an inspection, you can prove that you have acted with due care and that you are not liable.

Summary

An unreliable payer and an unreliable person are entities that are in serious breach of their VAT obligations. Dealing with an unreliable payer significantly increases the risk of liability for tax: you are liable if the supplier fails to remit the tax and you knew or should have known that there was a risk of non-payment – typically when the supplier is on the register as unreliable, you pay into an undisclosed account, the price is unusually low, part of the payment is to be in cryptocurrency, the cash exceeds the limit or the fuel lacks a distributor registration.

It is advisable to verify systematically: in the VAT register on the My Taxes portal by VAT number (discoverable via ARES if you only have an ID number), for EU shops via VIES and always check the published bank accounts. If you must carry out the trade even if the risk is higher, use a special way of securing the tax – send the VAT directly to the supplier’s tax authorities, thus exempting yourself from liability, or ask the supplier to publish the account with the tax authorities.

Frequently Asked Questions

Is there a list of unreliable VAT payers available for download?

The online VAT register is the most important one. It is updated daily and contains information on whether an entity is listed as an unreliable taxpayer.

What does a reliable VAT payer mean?

The law does not recognise the formal status of “reliable payer”. You can see in the register whether the entity is unreliable; if it is not, in common parlance it is called “reliable”.

How do I verify my EU partner?

Via VIES (European Commission website). Save the result – the tax administration directly recommends it.

What exactly should I do if the supplier wants payment to an account that I don't see in the register?

Consider a special way of securing the tax – pay the VAT to the supplier’s tax authority and pay the rest of the price without tax to the supplier. Alternatively, ask the supplier to publish the bill with the tax authorities.