Who and what can I find in the insolvency register?

“I borrowed from the bank. Is that why I’m on the debtors’ register?”

“A friend I did business with claims I owe him money and has taken me to court. Now he’s going to get me in trouble and on the insolvency register.”

The term “debtors’ register” is quite generic and the public tends to refer to various types of registers, including insolvency registers. In fact, there are several registers dealing with some form of debt and it is always necessary to distinguish which one is being referred to. In general, however, not all ‘debts’ and not all ‘debtors’ are entered in the insolvency register. So you can safely take out a consumer loan, mortgage or other similar loan and as an insolvency registry the justice will not enter these loans.

Similarly, if there is a normal court proceeding in which a sum of money is being recovered, it is not an insolvency proceeding that would be entered in the insolvency register. Neither is an execution, which is also sometimes confused with insolvency. Enforcement is the judicial recovery of a specific payment that the debtor does not want to voluntarily repay, although his assets would be sufficient to meet the debt. Executions are entered in the Central Register of Executions.

The Insolvency Register exclusively collects records of entities within the Czech Republic that are undergoing so-called insolvency proceedings. This is a special type of legal proceeding for the case when someone has, in the vernacular, grown over his or her head with debts and is therefore unable to meet his or her financial obligations for a long time. The insolvency procedure allows the debtor’s debts to be settled, so that he or she can start with a clean slate and at least partially pay off creditors’ claims.

For creditors, the insolvency register is a key source of information on the progress of insolvency proceedings. It allows them to keep track of important deadlines, such as the deadline for filing a claim in insolvency proceedings. Thanks to the transparency of the register, it is also possible to know if and when it will be possible to recover the amounts claimed. Creditors can thus better prepare for negotiations with the insolvency administrator or, where appropriate, plan other steps to secure their claims.

Tip for article

Tip: Do you have unpaid invoices on your desk? According to IPSOS, over 89% of businesses have dealt with a similar problem. And one in five have even experienced a situation where their invoice was not paid at all. Have you been in a similar situation? We’ll advise you on how to deal with overdue debts so that you can get your money back as soon as possible. What is the procedure and what to look out for? That’s what we’ll focus on in today’s article.

Are you solving a similar problem?

Do you have a problem with a debtor in insolvency?

We will assess your problem and draft a proposal for legal services to resolve it within 24 hours. We will help you get back to your finances.

I want to help you get your money

- When you order, you know what you will get and how much it will cost.

- We handle everything online or in person at one of our 6 offices.

- We handle 8 out of 10 requests within 2 working days.

- We have specialists for every field of law.

According to the data for the first half of 2024, a total of 10 797 persons were granted debt relief, which represents an increase compared to the same period of the previous year.

Justice – Insolvency Register

The Insolvency Register is managed and operated by the Ministry of Justice. The Justice website provides the Insolvency Register free of charge and can be found at https://isir.justice.cz.

One of the main advantages of the justice.cz insolvency register is its easy accessibility and free search. On the justice.cz insolvency register you can easily find all the information you need, not only about current proceedings but also about closed cases, which are stored there for five years. Thanks to this, you can check the financial history of both natural and legal persons at any time and take responsible decisions, whether you are a businessman, a creditor or an ordinary citizen.

Here you will find records of individuals (business and non-business) and legal entities. For each registered person, there is information about the person itself (that is, depending on the nature of the entity, ID number, registered office, birth number, residence), as well as the date and reason for initiating insolvency proceedings.

One file is kept for each debtor in which they are entered:

- the decision of the insolvency court,

- all submissions relating to the proceedings, unless the court decides that certain personal data shall not be disclosed,

- such other information as may be prescribed by law.

Tip for article

Tip: Other registers operated by other public or private entities should be distinguished from the insolvency register. The most important of these are the aforementioned Central Register of Executions, operated by the Chamber of Executors and SOLUS, where information on unpaid claims is shared between different economic sectors. These include, for example, banks, building societies, non-bank financial institutions, telecommunications service providers and energy distributors.

Can the insolvency register really be useful for everyone?

“I’m not a businessman. Why do I need an insolvency register?”

The fact that you are not a businessman and do not sign traditional business contracts does not mean that you do not conclude any “deals”. Every purchase on the internet, every order with a craftsman constitutes a contract and in some cases it is worthwhile to accompany them by consulting the insolvency register.

The Insolvency Register is a valuable tool not only for creditors, debtors and insolvency practitioners, but also for employers, entrepreneurs, landlords and generally anyone entering into any legal relationship with persons they do not know intimately.

For example, employers sometimes screen job applicants. Such “vetting” can be useful if they want to entrust a person with financial work, banking advice or financial management. They assume that a person who has not been able to manage his or her debts is usually not suitable for such work.

Similarly, it is a good idea for anyone to consult the insolvency register if they wish to enter into a sale or purchase from another person, for example, a property free from legal defects. But caution pays off even for items much less expensive than buying a home.

“I need to find who all “my” debtor owes. Can I find it in the register?”

If the debtor has filed an insolvency petition, he is obliged by law to list all creditors to whom he owes money. So this information can be found in the register. A plurality (i.e. at least two) of creditors is also a condition for opening proceedings, so at least one other creditor exists. If one of the creditors has filed a petition, it depends on which other creditors have filed their claims.

Tip for article

In our next article, we focus on insolvency-related offences that a debtor may commit against creditors in an attempt to improve his or her position.

What do I need to know to search the insolvency register?

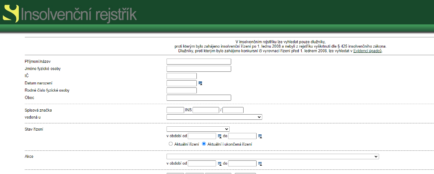

Searching the register is easy if you know some basic information about the person you want to check. For example, just enter the name and surname, the birth number, and in the case oflegal persons, the company registration number or the company name.

If you can find the person in the register, you can open their file (or the online version of the file, which may not be exactly the same as the physical file) and see a list of the filings and orders relating to their case. For each such record, you can see when it was made and you can also click on the full text of the record.

Can I find closed matters in the register?

Records are kept in the register not only during the insolvency proceedings but also for five years afterwards. This period cannot be shortened or waived in any way. Only the insolvency court has the power to delete them.

Summary

The insolvency register is a useful tool not only for entrepreneurs and creditors but also for ordinary citizens. It allows you to get an overview of the financial situation of persons or companies with whom you are planning business or other contractual relations. Thanks to the transparency of the register, you can avoid the risk of cooperating with debtors in insolvency, verify the credibility of your business partners or secure your claims by filing timely in the proceedings. Whether you are an employer, a landlord or just purchase services, checking the insolvency register can save you a lot of trouble. The Justice website offers the insolvency register free of charge. You can find it simply by typing the keyword “justice insolvency register” into a search engine.

Frequently Asked Questions

How exactly does the search in the insolvency register of natural persons on justice.cz work?

Searching the insolvency register of natural persons in the justice system is relatively simple if you know at least the basic identification data of the person you want to check. On the Czech justice.cz – insolvency register page, just enter your first name, surname and ideally your date of birth in the search form. The system will automatically offer all persons who match the entered data. If you are a natural person running a business, you can also use the registration number – this will make the search much more precise.

Once the results are displayed, click on the name to be taken to the individual file of the person in question, where you can see the complete progress of the proceedings. The Justice Insolvency Register also allows you to search by birth number – this is the most accurate method and eliminates name matches, but you do need to know it.

What can I find for a debtor in the ISIR (Insolvency Justice Index)?

The ISIR justice insolvency register provides very detailed information on the progress of insolvency proceedings. For each debtor, you will find a complete file in which all decisions of the insolvency court, creditor applications, motions, opinions and insolvency trustee reports are published. The file also includes a list of the debtor’s assets and liabilities, which is useful information for creditors and others dealing with the debtor.

In addition, you will find key information such as the date of the opening of the proceedings, the bankruptcy decision, the approval of the insolvency arrangement, the possible revocation of the insolvency arrangement and, finally, the termination of the proceedings.

How do I know that the person I am looking for is really "my" debtor and not just a name match?

Name matches are quite common in the insolvency register of justice debtors. Therefore, if a search returns multiple persons with the same first and last name, it is important to compare other data displayed by the insolvency register. The most reliable is the date of birth or birth number. In the case of natural persons in business, the registration number and the municipality of the place of business are also given.

It can also help to provide information on the place of residence – the insolvency register for natural persons lists the permanent address of each person. If you know your debtor’s place of residence, you can easily check that he or she is indeed the right person. If in doubt, we recommend opening the entire file – some documents may contain other identifiers that can help you confirm or deny the match.

What should I do if I find out in the Czech justice.cz insolvency register that someone I want to do business with is bankrupt?

Finding out that your potential business partner is bankrupt should be a warning sign. If the insolvency register of Czech justice.cz shows that a person is undergoing insolvency proceedings, it means that he or she has long-term difficulties in paying his or her debts. First of all, we recommend you to study the file thoroughly – you will see what debts he has, what creditors he has, and how his bankruptcy or insolvency is going.

If you are considering a business or contractual relationship, you should expect a high risk of non-payment. In practice, this often means only one thing: either refuse to cooperate, or make a significant contractual arrangement (e.g. payment in advance, security, pledge). In existing business relationships, you need to react quickly – if you are a creditor, keep an eye on the deadlines for filing a claim.

When and how is the data deleted from the insolvency register of debtors deleted?

Entries in the insolvency register of debtors do not cease immediately after the insolvency proceedings are closed. According to the law, they remain publicly available for five years after the end of the proceedings. Only then are they made inaccessible to ordinary users. However, this does not mean that the data disappear permanently – they continue to be archived for the purposes of the judiciary and other authorised entities.