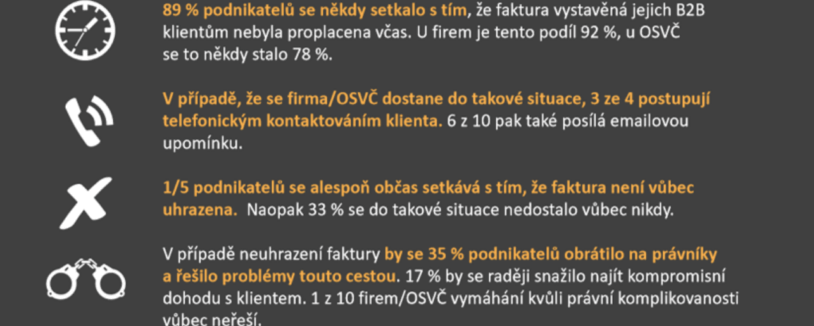

We find it interesting that one in ten entrepreneurs surveyed gives up on debt collection due to legal complexity and prefers to accept the loss. If someone owes you a debt, don’t be one in ten, and thanks to our article, find out that recovering your debt is not as complicated as it may seem at first glance.

Step Zero – advice for next time that can save you the stress of dealing with debt

We know it’s too late to chase the bull, but we see prevention as step zero. In practice, we have seen many times that small tradesmen in particular do not negotiate contracts in writing or require any confirmation of the agreement or delivery of goods. By doing so, they create the preconditions for themselves that the payment of the invoice may not take place.

Therefore, we recommend in any case:

- Have a clearly written contract, or at least a summary of the payment terms in a written order or an email order.

- Set the due date for payment of the price or remuneration as a fixed date or by meeting a certain condition, for example by completing the renovation of a specific part of the house. Of course, the contractual penalties are then properly set.

- You can also add the option of not paying the invoice or part of it if the performance is defective.

- It is advisable to check clients and business partners in advance and then demand stricter conditions regarding payments and guarantees in case of any risks.

- Do not download templates from contracts or have them checked by a solicitor where appropriate.

Are you solving a similar problem?

Debt recovery

Collecting a debt through our service will usually guarantee you a faster, more efficient and significantly cheaper solution. You’ll save yourself weeks or months of pleas and reminders to pay, and usually save on costly court settlements.

I want to help

- When you order, you know what you will get and how much it will cost.

- We handle everything online or in person at one of our 6 offices.

- We handle 8 out of 10 requests within 2 working days.

- We have specialists for every field of law.

The first step in debt recovery? Send a reminder

In our experience, we know that a high percentage of debt collection cases are resolved by the pre-suit demand for payment of the amount due. Sending such a pre-action notice is not mandatory, but if you skip this step, the court will most likely not award you costs, even if you win the case. Before sending a pre-action notice, it is advisable to check the debtor’s relevant registers to see if he or she is in insolvency or multiple execution. In such cases, recovery of the debt would be considerably more complicated. In our article, however, we will continue to work with the option that your debtor is sufficiently wealthy and it is within his means to pay the claim.

What should a pre-action notice contain?

There are several statutory requirements which, if omitted, could deprive you of an award of legal costs. In the event of a successful claim, the debtor will pay your solicitor’s costs for you. So what should you not leave out in a pre-action notice?

- Describing the acts that gave rise to the claim,

- the total amount of the debt,

- the length of the period within which the debtor has to pay the debt (at least 7 days),

- payment details for sending the amount due,

- ideally, an invitation to the debtor to state within a certain time limit whether he agrees to an out-of-court settlement of the claim, and a warning of the further procedure, which is the filing of an action and the higher costs involved.

Send the pre-action demand for payment to the debtor’s last known address. In the event of legal proceedings, it is not necessary to prove that it was served. Proof that it was sent is sufficient. We still recommend sending it by registered post to be on the safe side. At this stage, however, it is already worth considering whether it is worth having the pre-action notice drawn up by a solicitor. Not only will you avoid mistakes that could cost you more in any legal proceedings, but a notice drawn up in this way also has a greater psychological effect. Not only that, but the demand contained in the summons must correspond exactly to the subject matter of the action, i.e. the legal claim made. This is where a lot of people make the mistake on the basis of which the court may not award costs. This can lose you a lot of money. In our practice, we find that once a solicitor has signed the summons, it radically increases the likelihood that the claim will be paid at that point. We have repeatedly had counterparties who have dealt with several debts end up paying the demand notice sent by our solicitors in priority.

How can debt recovery be resolved out of court?

Most often, the counterparty is interested in agreeing on a repayment schedule or a partial remission of the debt with a condition precedent. The third way is to conclude a settlement agreement, where the existing obligation is cancelled and replaced by a new one. In any case, the debtor must acknowledge the debt in any agreement. It may be that, despite your efforts to resolve the debt out of court, this will not happen and a poorly drafted agreement could make your position in court proceedings much more difficult.

However, we are reaching a point where the debtor does not voluntarily pay the debt or the dispute is ultimately not resolved out of court. In this case, you have no choice but to go to court.

The second step in debt recovery – filing a lawsuit

The filing of a lawsuit and the subsequent court proceedings raise a number of issues. We will try to answer the questions that we most often address with our clients when they are about to go to court to collect a debt. What are they?

- Where, when and how to file a lawsuit? A lawsuit is generally filed in the circuit court located where the debtor resides or has a principal place of business. Of course, you must produce all documents, contracts, emails and other documentary evidence that shows beyond doubt that you have an existing claim with the debtor that he or she has still not paid you.

- I have read about the electronic payment order. What are its advantages? An application for an electronic order for payment is a specific kind of electronic claim. In order to use it, you usually only need to have a signed contract with the debtor or a confirmed invoice for the delivery of certain goods or services in your hands. Its advantages include faster processing compared to traditional court proceedings and, of course, lower court fees = 4% of the amount instead of 5% for traditional court proceedings. The court orders the defendant to pay the claim within 15 days or to file a statement of opposition within the same period. If the defendant does not lodge a statement of defence, the entire court proceedings end. The electronic order for payment has the same effect as a final judgment. However, in the event of a statement of opposition, a court hearing shall be ordered. This route is definitely recommended. We recently had an order for payment in our hands less than a week after the application was filed! So it really is very quick.

- Are there any disadvantages to the electronic payment order? It may not be a clear disadvantage, but the debt to be recovered must not exceed CZK 1,000,000. The second disadvantage is that the electronic order for payment must be delivered to the debtor by hand. Especially for notorious debtors, this can be a problem. In case of non-delivery, the court will automatically cancel the electronic payment order and the claimant will lose the possibility of a quick resolution. However, even in these situations it makes sense to file an application for an order.

- How much will the court proceedings cost me to recover the debt? The court fee and the cost of a lawyer must be taken into account. If you are unsuccessful in the court proceedings, you must calculate the costs of the other party. However, this is the advantage of an experienced lawyer who can assess your chances before the court proceedings begin and, if necessary, recommend that you withdraw the claim. The very act of filing can be a psychological tool. However, success can never be predicted one hundred percent. As experienced lawyers say, going to court is like going to sea.

- Court fees – how much will I pay? It always depends on the amount of the claim. For amounts up to CZK 20,000, the court fee is CZK 1,000. If you are recovering a debt between 20,000 and 40,000,000 CZK, the court fee is 5% of the amount. For an electronic payment order, the fees are lower and of course the law also provides for cases where you are exempt from the fees.

- What if I don’t have a contract but only an order in an email? Don’t despair. Anything can be used as evidence in court and even an acknowledgement of debt in an email or in front of a witness can stand. However, a well-prepared written contract is obviously a better starting position. An electronic payment order will be issued by the court whenever the claim appears from the petition to be justified; it is usually sufficient to base it on invoices and relevant correspondence.

- How long will it take to get my money? This is a question with an unclear answer. It always depends on the particular court and its caseload. Thus, the length of the proceedings can range from a few months to several years. The defendant’s activity is also a factor.

“I contacted the Affordable Advocate for help with a defaulter. The Affordable Advocate advised me on how to proceed. Our dispute went all the way to the courts, where the Affordable Lawyer represented me. I won the case and I can highly recommend the services of this website.” Štěpán Mičunek, managing director of HVFree s.r.o.

When debt recovery does not end even with a successful court case

Unfortunately, there are also situations where you succeed in court proceedings but the defendant fails to fulfil its obligation as stated in the court decision. In such a case, there are two possible options – enforcement of the judgment through the court or an application for enforcement through a bailiff. In the case of the second option, there are many models of enforcement motions circulating on the internet. However, no one can guarantee their completeness and accuracy, so it is advisable to consult a lawyer in this case. You can then file an execution petition with any bailiff – you can find a list on the website of the Chamber of Executors.

Who should I contact for debt recovery?

A search on the internet will bring up a number of collection agencies. We will not evaluate their procedures here, which were the subject of an interesting article on iRozhlas.cz. You can use their services only in the case of out-of-court debt collection, otherwise it would be unauthorised legal services – so-called collection, which is an offence or even a criminal offence under the Advocacy Act.

In the case of a law firm, you are guaranteed professionalism, legality and the possibility of obtaining the so-called “surcharge” (the lawyer’s fee for legal services rendered), which is usually awarded to the creditor by the court in the event of a successful court case. In the end, the debtor has to pay you not only the claim but also the amount of the lawyer’s fees.

Tip for article

Tip: If you want to have your claim resolved as soon as possible, the Available Advocate will send a pre-action notice to the debtor within 3 days.

There is a lot of misinformation about how debt collection and debt recovery works. In most cases, however, it is neither complicated nor that financially and psychologically demanding. In a significantproportion of cases, it is resolved at the first action in the form of a pre-action notice. But don’t worry about a possible lawsuit either. Thanks to the representation of a lawyer, you will be perfectly prepared for everything, and in the end the debtor will pay his fee anyway.