What is an IČO

An ID number is an abbreviation for a person’s identification number and represents the basic data of every entrepreneur, legal entity or organisation in the Czech Republic. It is sometimes referred to as an “IČ” in common parlance.

An ID number takes the form of an eight-digit number that is unique and uniquely distinguishes each business entity from others. This code is assigned to businesses:

- the trade licensing office (in the case of self-employed persons),

- the registration court (for companies),

- other specialised institutions (e.g. the Federal Register).

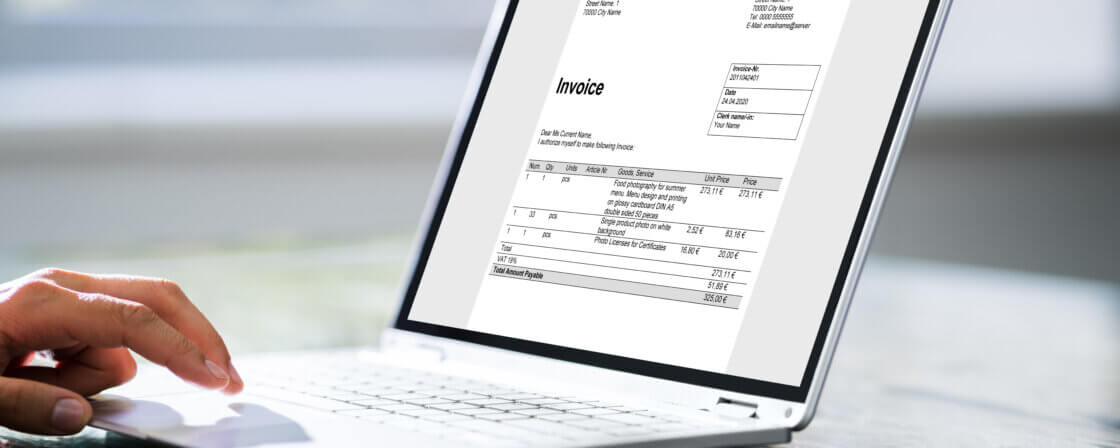

The ID number is necessary for communication with the authorities, it appears on invoices, contracts, company websites and in business dealings. So, if someone is looking for an answer to the question what is an ID number, then we can say that it is the basic identifier of a business.

How to find out your ID number

Many people ask how to find out their business ID number or how to find out the ID number of the company they want to do business with. The reasons can vary from needing to issue an invoice to checking the reliability of a business partner to wanting basic information about a competitor. Fortunately, today there are several easy ways to look up an ID number:

- ARES (Administrative Register of Economic Entities): this is a publicly available online database managed by the Ministry of Finance. Just enter the name of the company, the name of the entrepreneur or directly the ID number and in no time you will get a detailed overview – the registered office, the date of establishment, the subject of business and the current status of the company.

- Trade Register: if you are looking for the registration number of a natural person – self-employed, this register is ideal. Here you will find details of businesses registered with the trade authorities, including their identification number and other details of their trade licence.

- For limited companies, joint stock companies, cooperatives or foundations, theCommercial Register is a key source of information. The company’s registration number is always included for each entry. The advantage is also an overview of the statutory bodies and the possibility to download an up-to-date extract.

- Your own documents. You will find it on all official documents related to the business, typically invoices, contracts, certificates from the authorities or even on the trade certificate.

Are you solving a similar problem?

Not sure about your tax obligations?

Did you know that putting the wrong ID number or VAT number on an invoice can have legal and tax consequences? Or that you must have the correct “tax number” when doing business abroad? If you are not sure how to register your company, whether you should become a VAT payer or how to issue invoices with a VAT number and tax number, please contact us.

I have a question

- When you order, you know what you will get and how much it will cost.

- We handle everything online or in person at one of our 6 offices.

- We handle 8 out of 10 requests within 2 working days.

- We have specialists for every field of law.

What is a TIN

A TIN or tax identification number is a unique designation used by the Financial Administration to record all tax entities in the Czech Republic. Its main purpose is to make it clear to the state and businesses who is obliged to pay taxes, file returns or pay VAT. It can be said that while an ID number identifies you generally as an entrepreneur or company, a TIN uniquely identifies you in the tax system.

The TIN is essential especially when issuing invoices and tax documents, in international trade (for deliveries within the EU), when communicating with the Tax Administration and when registering for VAT and other tax obligations.

The typical form of the VAT number is composed of the abbreviation of the country and the identification number. In the Czech Republic, the prefix CZ is used, usually followed by the business ID number. The resulting form looks like, for example, CZ12345678. This format is mainly used for legal entities and self-employed persons registered for VAT.

Historically, for some individuals, the VAT number could be derived from the birth number. This is why the question still arises today whether the registration number and the VAT number are the same. The answer is: it is not. Today, it is standard practice to allocate VAT numbers according to the registration number and birth numbers are not used in this context.

It is important for entrepreneurs and companies to have the correct TIN on all invoices and business documents. If you are a VAT payer, it is compulsory to have the VAT number on the invoice, because it is the reason why the tax authorities and the business partner can verify whether the transaction is correctly taxed.

Internationally, the term “tax number” or VAT number is used instead of VAT number. If you are trading with foreign countries, you will need it.

How to find out your VAT number

If you’re wondering how to find out your VAT number, there are several options depending on whether you’re a VAT payer or just looking for your tax identification number for another tax liability. The most common ways are:

- The portal of the Tax Administration: The fastest way is to use the public register of VAT payers, which is managed by the Financial Administration of the Czech Republic. Just enter the name of the company or VAT ID number and you will find out in no time if the entity is a VAT payer and what VAT ID number it has been assigned. This procedure is suitable not only for verifying yourself, but also for checking your business partners to make sure that you are invoicing correctly.

- Tax documents and correspondence: you will also find your VAT number on all official documents received from the tax office. These are typically VAT registration decisions, tax certificates or the tax returns themselves. If you are self-employed or a company and communicate with the authorities electronically, you will also find your VAT number in messages in your data box.

- Accounting and invoicing system: If you use accounting software (e.g. Pohoda, Money S3, iDoklad or other), then you have the TIN filled in the basic user profile. The software automatically lists it on invoices and other documents.

- Your accountant or tax advisor: If you work with an accountant, you can simply contact them directly. The accountant has your tax information and can provide you with the TIN immediately. The same applies to the tax adviser who prepares your return for you.

- Banking or commercial documents: In many cases, the TIN is also included in commercial contracts, bank forms or loan documents. This is because banks and business partners work with your identification data, including your TIN.

Tip for article

Tip: Does your employer offer you a job with an IČO instead of a regular employment contract? Read our article to know what this means for you and what to look out for.

The difference between an ID number and a VAT number

Although people often confuse the two, an IČO and a TIN have different purposes.

- An IČO is the identification number of an entrepreneur or company. It is used in business dealings, contracts, invoices, registers.

- TIN – tax identification number, which is important mainly for communication with the Tax Administration and when paying taxes.

If you issue an invoice, you always include the VAT number, whereas you only include the VAT number if you are registered for VAT.

Summary

The VAT number and the VAT number are two basic identification data for entrepreneurs and companies, but they have different functions. The ID number (personal identification number) is an eight-digit code assigned by the trade licensing authority, the registry court or another institution and is used to identify the entrepreneur or company in general – you will find it on invoices, contracts or in registers (ARES, commercial or trade register). The Tax Identification Number (TIN) is used by the Tax Administration to record tax obligations, its typical form is CZ + IČO, and it is mandatory especially for VAT payers; in the past it could be derived from the birth number, but not anymore. The TIN is essential for invoicing, communication with the authorities and in international trade, where it is often referred to as a “tax number” or VAT number. It is easy to find out your VAT number and VAT number – via public databases (ARES, VAT register), on tax documents, in accounting software, in a data box or via an accountant. In short: every entrepreneur must have an ID number, only those who are registered for taxes (most often for VAT) must have a VAT number.

Frequently Asked Questions

What is an ID number?

This is the eight-digit identification number of the business or organisation.

What is a TIN?

A tax identification number used for tax registration purposes.

How do I find out my ID number?

You can find it in ARES, the trade or commercial register, or on invoices.

How do I find out my VAT number?

In the VAT register, in your tax correspondence or in your accounting system.

Does every entrepreneur have to have a VAT number?

No. The VAT number is assigned mainly to VAT payers, while every entrepreneur is obliged to have an ID number.

VAT number and birth number - what is the difference?

The birth number identifies the citizen, the VAT number is for tax purposes. Historically, the birth number was sometimes used as a TIN, but not anymore.