It is not enough to have well-written contracts to close a good deal. You also need to know who you are contracting with. Depending on the type of contract you are entering into, you can then check various public sources and do some research on the counterparty.

By simply entering the name of an individual or company, we can find out many interesting things: economic or criminal cases in the media, various reviews and statements by clients or former business partners. If we want to dig a little deeper, there are various registers.

Are you solving a similar problem?

Does anyone owe you money?

Did someone violate your rights? In our experience, a pre-suit notice is the most effective and least expensive way to protect your rights. It serves as a last warning before a lawsuit.

Do you want to make a strong defense? We’ll stand up for you. We’ll help you get what’s coming to you with a pre-suit demand. The advantage is that it can be done without having to file a lawsuit, pay court fees, and risk paying the opposing party’s litigation costs.

I want to help with a pre-suit challenge

- When you order, you know what you will get and how much it will cost.

- We handle everything online or in person at one of our 6 offices.

- We handle 8 out of 10 requests within 2 working days.

- We have specialists for every field of law.

Which registers to look at?

For basic information, we’ll probably head to the commercial register. Here we can find all the essential information such as the company’s registered office, who can act for the company, what its share capital is and so on.

If we expect mutual financial transactions, then the debtors’ register should be at the centre of our concern. However, there are several types of registers and it is always important to distinguish which one is being referred to.

The most important of these is the Central Register of Executions, operated by the Chamber of Executors. In it we can find information on pending executions conducted by members of the Chamber. However, not all pending foreclosures are recorded here, for example those conducted by state authorities or health insurance companies. Another very useful resource is SOLUS, where different economic sectors share information on outstanding debts (more than three months). These include, for example, banks, building societies, non-bank financial institutions, telecommunications providers and energy distributors.

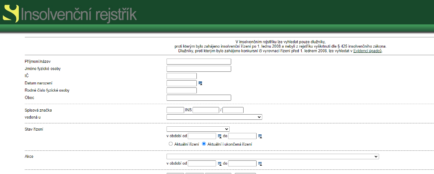

In addition to the commercial register, check also the insolvency register ISIR, which is operated by the website justice.cz. This register provides an overview of pending insolvency proceedings, their status and the parties involved. If you suspect insolvency proceedings against your business partner, check here. The insolvency justice debtors list is a useful tool for checking the counterparty before entering into a contract.

Thanks to the insolvency proceedings, the debtor’s debts are settled and the debtor can thus start with a “clean slate” and the creditors’ claims are at least partially settled.

For a more detailed overview of insolvency, you can use the justice insolvency calculator available on justice.cz, which allows you to calculate the debtor’s non-recoverable amount. This will give you a better understanding of their financial situation.

What if a business partner is insolvent?

If you find that your business partner is listed in the insolvency register on justice.cz, this means that he or she is involved in insolvency proceedings. The insolvency court then decides on the next course of action – for example, whether to approve debt relief or liquidation. If you want to investigate this further, it is worth making an enquiry at isir justice.

Several basic conditions must be met for insolvency to be declared:

- the debtor has at least two creditors,

- the debtor has at least two debts more than 30 days past due,

- the debtor is unable to pay his debts.

If the insolvency petition is approved, the person in insolvency starts to repay his debts as much as possible, but always has a non-repayable amount left. This varies annually according to the minimum subsistence level and the standard cost of living and increases with the number of dependants (spouse, children). The amount of the non-forfeitable amount can be calculated in the insolvency calculator, which is also available on the justice.cz website.

If the debtor has filed an insolvency petition, he is obliged by law to list all creditors to whom he owes money. If one of the creditors has filed a petition, it is up to the other creditors to add their claims.

How to proceed if your debtor is insolvent?

As a creditor, you can file an application in the insolvency proceedings to assert your claim against the debtor. By doing so, you express your wish to have the debtor repay a part of it to you in the insolvency proceedings. The application must be made on the prescribed form, with supporting documents to prove the existence and amount of the claim. The deadline for filing the application is very important and must be respected by the creditor, otherwise his claim will not be included in the insolvency proceedings.

The only exceptions are claims against the assets and their equivalents, which can be filed at any time during the insolvency proceedings and are not filed by way of an application. However, this generally does not apply to ordinary creditors, mainly the insolvency administrator’s remuneration and expenses and other claims listed in the Act that arose after the decision declaring insolvency.

There is a specific mandatory electronic form for filing a claim, so it cannot be filed in any other way.

Tip for article

Tip: Has a friend asked you to guarantee his loan? Consider well whether the friendly service is worth the potential trouble. If you think it is, study everything beforehand to be sure, consult a lawyer about the contract and perhaps read our article on how not to get into trouble as a guarantor.

How do insolvency proceedings end?

Debtors sometimes mistakenly believe that they have to send the court an application to end the insolvency proceedings. In reality, however, the insolvency procedure ends with the court’s decision approving the insolvency administrator’s report on the implementation of the insolvency procedure. As part of this decision, the debtor is released from the obligation to pay outstanding debts or debts that were not (and should have been) entered into the arrangement at the time of its approval. In this context, the debtor should serve the court with a petition for exemption from payment of the remaining debts. The debtor’s exemption from repayment of unsatisfied debts does not apply to debts incurred through criminal activity or incurred during the period of the arrangement.

Insolvency proceedings (debt relief) now normally last 3 years for all debtors. The law no longer requires a certain percentage of debts (e.g. 30%) to be repaid in order to be discharged. The condition is that the debtor must make every effort to pay his/her debts during the period of insolvency. Based on an assessment of his behaviour, the court will decide whether to forgive the rest of the debts.

After the insolvency proceedings are closed, the records are kept in the register for a further five years. Thereafter, the insolvency court will delete the records automatically. If you need a template for an application for expungement from the insolvency register, you can find it online or contact our law firm. Keep in mind, however, that an expungement does not normally need to be applied for as it is done automatically.

The insolvency ends with a court decision, by which the court confirms that the conditions of the insolvency have been met and usually also decides to release the debtor from the rest of the outstanding debts. The debtor submits a proposal for this, but the insolvency court’s assessment is decisive.

Summary

Before entering into an important contract, check the counterparty in public registers such as the Commercial Register, the Insolvency Register ISIR or the Central Registry of Executions. Use registers such as SOLUS or justice.cz, which provide information on foreclosures and insolvencies, to determine the financial situation of the counterparty. If you find out that your business partner is insolvent, you can file your claim using the electronic form on justice.cz. The deadline for filing is important. Insolvency proceedings end with the court’s decision. If the debtor proves that he or she has made every possible effort to repay the debts over a period of three years, the court may exempt him or her from the rest of the outstanding debts. The records of the closed insolvency proceedings are kept in the insolvency register for 5 years, after which they are automatically deleted. If you need legal help, for example with a pre-action notice, contact the experts. This step can be effective without the need for court proceedings.

Frequently Asked Questions

How do I find out if a company or sole trader is insolvent?

The most reliable is the Insolvency Register (ISIR) on the justice.cz website. Simply enter the name, company name or registration number and you will immediately see whether the person is subject to insolvency proceedings and at what stage they are.

How long does it take to get debt relief today?

From October 2024, the period of debt relief is reduced to 3 years for all debtors. There is no longer an obligation to repay a minimum percentage of the debts (e.g. 30%). The condition is that the debtor must prove that he or she has tried to repay as much as his or her situation allowed throughout the whole period.

How much money is left to the debtor in insolvency?

Everyone must be left with a so-called “non-forfeitable amount” to ensure that they have the basic necessities of life. The amount is calculated according to the current minimum subsistence level and the standard cost of living. Since 2025, there have been minor changes in the calculation methodology, so we recommend using the official calculator at justice.cz.

What should I do if I find out that my business partner is insolvent?

As a creditor, you must file a claim in a timely manner using the mandatory electronic claim form. If you fail to do so within the deadline, your claim will not be taken into account in the proceedings.

When are insolvency details deleted from the register?

The record of the completed insolvency proceedings is kept in the insolvency register for 5 years after the insolvency proceedings are completed. Thereafter it is automatically deleted. No special request for deletion is necessary, unless the court annuls the proceedings or other specific circumstances arise.