What is the Child Tax Credit and who is entitled to it?

Child Tax Credit is a tax benefit that you, as a parent, can claim for each of your dependent children living in the same household as you. Not only parents, but also adoptive parents, foster carers or people who have custody of a child by a court order. In legal terms, the Income Tax Act regulates the child allowance.

Who can claim the child tax credit

Only one spouse can always claim the child tax credit. However, in the case of families with several children, it is possible for each parent to claim the allowance for one of the children if they do not want only one of them to claim the allowance for all of them.

Under what conditions can you claim the discount?

- The age of the child is important: you can apply the discount to children up to 18 years of age. But be warned, if your child decides to go to university or take advantage of another type of education, in short, the child continues to study, your entitlement to child tax credit is extended until the child is 26.

- The child must have dependent status: a dependent child is one who is in education, has no income of his/her own or is unable to support him/herself. This may be due to a disability, for example. In other words, once your child loses his or her student status and starts earning an income (earnings while studying may not play a role in this case), your entitlement to claim child benefit ends.

- Where the child lives also plays a role: To claim child tax credit, your child must be part of a household in the Czech Republic or another EU/EEA country.

You also need to clarify who all falls under the category of “child” in this case. These are:

- your own child,

- an adopted child,

- a child in care replacing the care of parents,

- a child who has acquired full legal capacity or has reached the age of majority in foster care,

- a child of the other spouse,

- his/her own grandchild/grandchild or the grandchild/grandchild of the other spouse, if his/her parents do not have sufficient income on which to claim the child allowance.

Conversely, you cannot claim the child credit for the offspring of your spouse, even if he/she lives in the same household as you. Once you are not married, you are not entitled to this benefit.

Are you solving a similar problem?

We can also advise you on taxes

Do you feel that taxes and lawyers don’t go together? No way! At our law firm, we can also help you resolve problems with a poorly filed tax return or any other issue that involves this area.

That's what I'm wondering

- When you order, you know what you will get and how much it will cost.

- We handle everything online or in person at one of our 6 offices.

- We handle 8 out of 10 requests within 2 working days.

- We have specialists for every field of law.

The difference between a tax credit and a deduction from the tax base

In practice, there is often confusion about what is a tax rebate and what is a deduction (the non-taxable part of the tax base). The deduction first reduces your tax base, only on this reduced base is the tax calculated. A tax credit, on the other hand, is only deducted from your calculated tax – so it directly reduces the amount you would otherwise pay to the government. That’s why the same amount has a stronger effect with a rebate than with a deduction: a rebate of CZK 10,000 will reduce the tax by the full CZK 10,000, whereas a deduction of CZK 10,000 will only reduce the tax base, and the real saving is equivalent to 15% of the tax on that amount (i.e. CZK 1,500 at a rate of 15%). Child tax credit is a tax rebate – and it’s even a special rebate that turns into a tax bonus paid on account if there is insufficient tax.

How much is the child tax credit in 2025

The amount of the child tax credit varies depending on how many children you claim it for. From 2022, the amounts will increase. This reflects the government’s efforts to support large families.

The current amounts are:

- For the first child: CZK 15,204 per year (CZK 1,267 per month).

- For the second child: 22 320 CZK per year (1 860 CZK per month).

- For the third and each additional child: CZK 27 840 per year (CZK 2 320 per month).

The law does not specify the order in which you must list your children, meaning that the oldest child does not necessarily have to be first. If one of the children has a PWD/P card, you can list him/her third to reach the maximum amount.

Wondering how this works in practice if you have more than one child? If you have three children, you can deduct a total of CZK 65,364 for the year. This amount is deducted directly from your income tax. If the deduction exceeds your tax liability, you will receive the difference as a so-called child tax bonus. So a family with three children where the couple’s annual tax liability is CZK 50,000. After the tax credit is applied, they will get CZK 15,364 as a bonus because the total credit (CZK 65,364) exceeds their tax liability.

Tip for article

Find out what influences net pay and how it differs from gross pay.

How do I claim the child tax credit?

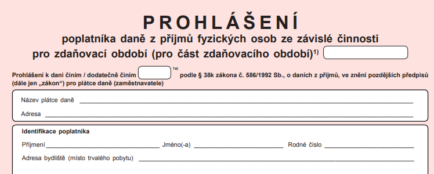

Employees can claim child tax credit through their employer. All they need to do is provide the child’s birth certificate, proof of education (if the child is over 18) and other necessary documents, such as proof that the other parent does not claim the allowance.

Entrepreneurs and self-employed persons (self-employed) can claim the child tax credit when filing their tax return. The amount of their deduction depends on their taxable income and any entitlement to the child tax credit.

Some employers may ask for confirmation that the child tax credit has not been claimed. They want this certificate mainly to avoid a situation where both parents claim the child credit at the same time. So if the other parent does not claim the allowance, they must provide written confirmation that they do not do so when asked by the other parent’s employer.

When is an affidavit required?

If the parents take it in turns to care for the child (for example, alternate care), they must provide an affidavit as a document that clearly identifies which parent will claim the tax credit and for which period. This affidavit must include:

- The child’s name and date of birth.

- A statement that the other parent does not claim tax relief for the child.

- The date and signature.

Tip for article

Not sure how to fill in your income tax return? Our article will help you with that.

What is the child tax credit?

The Child Tax Credit is direct financial help that parents receive if the Child Tax Credit exceeds their tax liability.

Eligibility:

- Minimum monthly income of at least half the minimum wage (for 2025 this is CZK 10,400 per month), for self-employed persons the minimum annual income is six times the minimum wage (for 2025 this is CZK 124,800).

- Meeting the conditions for claiming the child tax credit.

The tax bonus is not available to the long-term unemployed, persons receiving a retirement pension, persons whose income is derived only from rent or capital assets.

Employees are paid the bonus monthly in net wages (or in annual settlements), self-employed persons in one lump sum when filing their tax return.

What does this look like in practice?

For divorced parents, only the parent who has sole custody of the child claims. In the case of alternate custody, you can claim the allowance pro rata – e.g. one parent claims the allowance for the first half of the year and the other parent for the second half. Model example. They have agreed that the father will claim the discount for the first half of the year and the mother for the second half. Each of them must sign a “child discount affidavit” to comply with the law.

Mrs Little has three children, one of whom is disabled. As the discount on children with a PWD/P card is doubled, Mrs. Malá can claim the higher child tax credit.

When claiming the child tax credit, it is often a common mistake for both parents to claim the benefit. This can lead to them having to make up the difference in tax and even risk penalties. Complications can also arise if you do not submit an affidavit of non-application of the child tax credit or any other necessary document on time.

Once the month comes when the child stops or starts qualifying for your child tax credit, you can still claim the child tax credit. This is because the law says that it can be claimed for each calendar month in which the child qualified at the beginning of that month. So if your child is born at the end of the month, you can still claim the allowance for that month.

Summary

One parent (or an adopter, foster parent or carer) is entitled to the child tax credit for each dependent child in the household up to the age of 18, or up to the age of 26 when studying; the child must be a permanent resident of the Czech Republic or the EU/EEA. Only one spouse can claim the credit for the same child (not for a partner); for multiple children, parents can split the credit; for a disabled person with a disabled person’s card, the amount is multiplied by two. The annual amounts are CZK 15,204 for the first, CZK 22,320 for the second and CZK 27,840 for the third and each additional child; the order of children is not fixed, so it pays to “rank” them correctly. If the rebate exceeds the tax, you will receive the additional payment as a tax bonus (but eligibility requires a minimum income – at least half the minimum wage per month for employees, or six times the minimum wage per year for self-employed workers). Watch out for common mistakes: double claiming by both parents, not providing an affidavit or proof of studies.

Employees claim the discount through their employer (birth certificate, in the case of older children a certificate of studies or a certificate stating that the other parent does not claim the discount); self-employed persons in their tax return. For alternate care, an affidavit is required and it is possible to alternate semesters. The bonus is not available to, for example, the long-term unemployed, recipients of a retirement pension or people with income from rent or capital assets only. In practice, keep an eye on the order and documents for multiple children to take full advantage of savings of up to tens of thousands of crowns a year without penalty.