Quick overview

You complete the taxpayer declaration by providing your identification details, selecting the reliefs claimed and entering children for tax relief where applicable.

-

You only sign the declaration for one employer.

-

It must be filed by February 15 or within 30 days upon hire.

-

No discounts can be claimed without a signature.

-

Report changes (e.g., birth of a child) within 30 days.

If you’re not sure how to apply the discounts correctly, or if you have overlapping employment and business, use our online advice to avoid paying more than you have to.

What is an income tax return

The personal income tax payer’s declaration, often referred to as the ‘pink declaration’, is a mandatory document that employees must complete and submit to their employer each year. This declaration is used to determine how income tax is paid. After all, it is also in their interest as it allows them to benefit from tax relief.

Tip for article

Tip: Tax is not only paid on income, but also on real estate. Read our summary on property tax. Find out how much it is, when it is due and how to apply for it.

The basic prerequisite for claiming tax credits via the pink declaration is that the employee can only sign the taxpayer declaration with one employer. It does not matter whether he/she works full-time or part-time or whether he/she is employed by the employer under a performance or employment agreement.

The taxpayer’s declaration is filed once a year, normally at the beginning of the calendar year by 15 February or, if you change jobs, within 30 days of starting your new job. If changes occur during the year that would affect the amount of tax credits claimed (for example, the birth of a child), the employee should file an updated statement, again within 30 days of the event (birth of a child).

Are you solving a similar problem?

Not sure how to do your taxes properly so you don't get it wrong?

We can help you navigate the law, whether it’s dealing with a specific tax situation, preparing for an audit by the tax authority or defending yourself in court.

I have a question

- When you order, you know what you will get and how much it will cost.

- We handle everything online or in person at one of our 6 offices.

- We handle 8 out of 10 requests within 2 working days.

- We have specialists for every field of law.

Pink slips with two employers

As we have already announced, the income taxpayer’s declaration can only be signed with one employer. So what are the risks if you sign it with more than one employer?

If you sign a pink declaration with two or even more employers, tax credits are incorrectly claimed, resulting in an underpayment of income tax. In the Czech Republic, the principle is that tax credits can only be claimed once and from one employer, typically the one with whom the employee has his/her main employment relationship.

Therefore, if your employer discovers that you have signed the taxpayer’s declaration twice, they must deduct from your wages an amount corresponding to the difference in tax. However, if he has already filed a tax return, then he must notify the taxpayer, i.e. you, of the debt. Once the tax office discovers that you have claimed tax credits from more than one employer, it will claim additional tax for the period when the credits were incorrectly claimed. In addition to the additional tax, you may also be liable for a penalty.

In practice, the most common situation is that employees sign a declaration with two employers at the same time. This leads to an assessment of tax and penalties. However, it is also a common mistake not to declare the change for a child studying after graduation.

Who completes the taxpayer declaration

The pinkdeclaration is completed by all employees. It does not matter if they are also students or pensioners. Similarly, sole traders who are also employees complete the taxpayer declaration. However, their employer may not sign their annual tax statement. They must arrange this themselves when they file their tax return.

Tip for article

Tip: Trade or job? How about trying both? What are the advantages of such a combination and what can stand in your way of doing business? We’ll give you some advice in our next article.

How to fill in the income tax declaration

Basic information

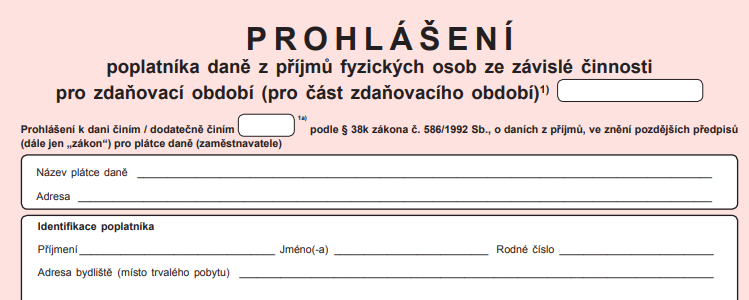

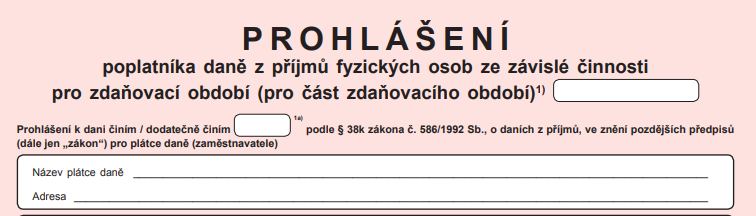

The first field to fill in is the tax period. This is the year for which you are filing. Only fill in the next box ‘I am making an additional declaration’ if you are making an additional declaration. In this case, you will write XD in it.

In the first table you need to fill in the name of the taxpayer and his address. The taxpayer is your employer, so fill in the full name of the company (e.g. Available Advocate s.r.o.). Similarly, fill in the exact address of the company’s registered office (e.g. V Jama 699/1, 110 00 Prague 1 – Nové město)

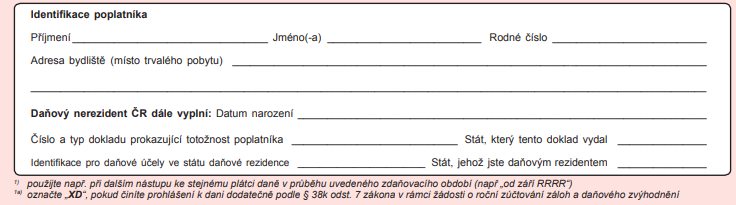

Identification data

In the table called Taxpayer Identification, you fill in your first name, last name, birth number and address of your permanent residence. In case you do not have Czech nationality, you also fill in the second part of the table, i.e. “Tax non-resident of the Czech Republic will fill in further“. Use your passport or ID card issued in your country to fill in the details of the taxpayer’s identity document.

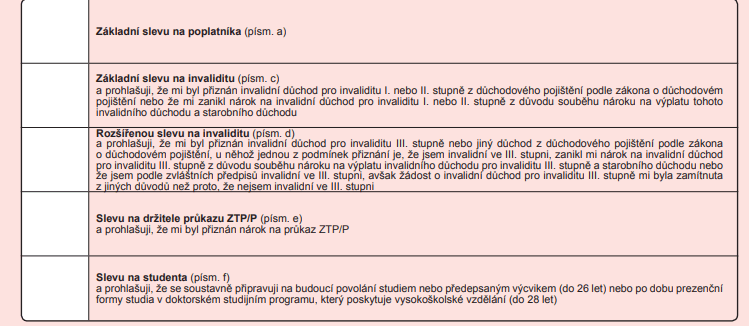

Tax rebates

The second table includes all the possible tax credits you can claim. Here you tick the X for the discounts that apply to you. Or XD if you are claiming them retrospectively.

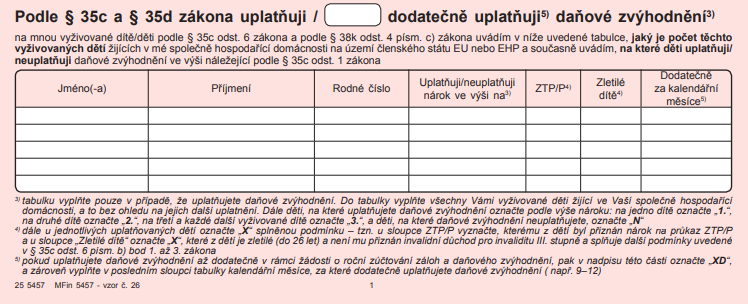

Child tax credit

This section relates to the child tax credit. However, you must meet several conditions to qualify for Child Tax Credit :

- You must have a dependent child living in the same household as you. A dependent child in this case means your own biological child, an adopted child, a child in foster care even after the end of foster care due to majority or legal capacity, a stepchild and a grandchild whose parents do not have income to claim the tax credit.

- The benefit can be claimed up to the child’s 18th birthday if the child is no longer in education or up to the child’s 26th birthday if the child is still in education.

- The child tax credit can only be claimed by one parent at a time. For this reason, the parent who does not claim the benefit must provide a certificate stating that the tax credit has not been claimed. If this parent is not an employee, then he or she must submit an affidavit of non-application of the child tax credit. Similarly, the absence of the other parent must be documented. This requires a certificate or affidavit.

If you meet all the conditions, then you can file. Here you fill in your child’s first name, surname, birth number and write whether or not you apply the discount (yes/no). If your child is a PWD/P, then tick this box with an X. If your child is over 18 years old but still studying, tick the ‘Adult child’ column with an X. However, you will also need to provide proof of your child’s studies.

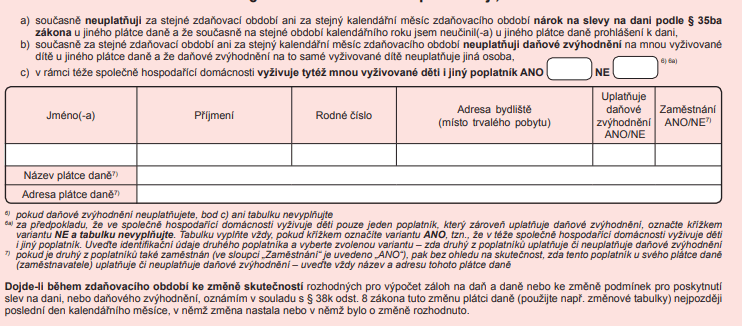

Other parent of a dependent child

Here you first tick yes or no. Yes if you share a household with another taxpayer who is supporting your children. If you fill in yes, you must also fill in the table below. This is where you give the name, surname, birth number and permanent address of the other person (parent). And you fill in yes or no depending on whether that person claims the benefit.

Then in the last column you fill in yes or no again depending on whether the other person is employed. In the next row, you fill in the name of the company where this person works and one row below that the address of this company.

Signature and date

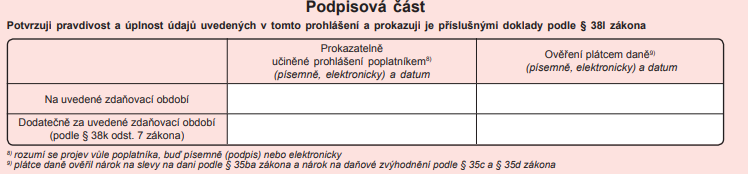

In the signature section, write your signature and the date of signature in the column “Taxpayer’sdeclaration”. You select the line depending on whether you are filing the declaration for the tax year indicated or subsequently for the tax year indicated.

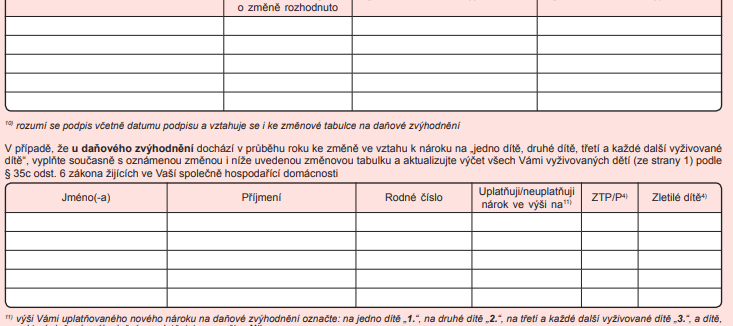

Changes in entitlement to discounts or allowances

The last change section only applies to you if you have changes during the year that affect the taxpayer’s declaration and claim for tax credits. This could be, for example, the birth of a child, leaving education or developing a disability.

In these cases, you need to fill in what type of change it is and in what month the change was decided or occurred (for example, a decision may have been made to grant disability while the birth of a child may have occurred). In the third column, add your signature and the date of signature. If the change concerns dependent children, also use the table below to add your child’s details.

Not sure if you have everything correct? Let us know – we can do an initial assessment of your situation online.

Summary

The taxpayer’s declaration (‘pink form’) is a key document that allows you to claim tax credits and child tax credits from your employer. You can only sign it with one employer and usually by 15 February of the year, or within 30 days of starting work. You must report any changes – such as the birth of a child or the end of your studies – within 30 days.

Filing or signing errors with multiple employers can result in tax assessments and penalties. If you are unsure of the correct procedure, especially when you are working and running a business at the same time or dealing with an underpayment, it is worth consulting a professional.

Frequently Asked Questions

Do I have to sign a pink slip every year?

Yes. The taxpayer declaration is signed again for each tax year, usually by 15 February of that year. Without a new signature, your employer cannot claim tax credits.

What happens if I sign a declaration with two employers?

If the discounts are incorrectly applied, a tax underpayment will arise and the tax authority may assess the tax, including penalties or interest on late payment. Discounts can only be claimed from one employer at a time.

Is it possible to sign a declaration for a work performance agreement (WPA)?

Yes, but only with one payer. If you do not sign the declaration, the tax will be withheld without claiming any credits (lower incomes may be subject to withholding tax).

By when do I have to report the birth of a child or other change?

Changes that affect discounts or tax benefits (e.g. birth of a child, termination of studies, disability) must be reported to the employer within 30 days of their occurrence.

Can both parents claim the child tax credit?

No. Only one parent can claim the tax credit for a given month. The other parent must provide proof that he/she does not claim the benefit.

Do I have to file a tax return if I have both a job and a business?

Yes. If you have business income or other taxable income in addition to your employment, you cannot file an annual employer’s tax return and must file your own.

Can I submit my pink declaration electronically?

Yes, if the employer allows it (e.g. via an internal system or electronic signature). However, the declaration must always be verifiably signed and delivered to the employer.