Removal from the debtors’ register after insolvency: How does it work?

After insolvency, former debtors often find that their name is still on the registers, which prevents them from taking out new financial products. However, removal from debtors’ registers after insolvency is not automatic and depends on the type of register.

What kind of registers do we have?

- Bank Register of Customer Information (BRKI)

- Non-bank register of customer information (NRKI)

- SOLUS

- Insolvency register

Each of these registers has its own rules for the processing and deletion of data. We have discussed the debtor registers in more detail in a separate article.

Deletion from SOLUS after insolvency

SOLUS is a non-banking register that records the debts of consumers. After insolvency, the record remains in it for up to 3 years. The advantage is that you can apply for deletion even earlier if you can prove that you have properly resolved your liabilities.

What should the application contain?

- Your identification data (name, birth number, address)

- Evidence of the end of the insolvency (e.g. court decision)

- An explicit request for erasure on the grounds that all liabilities have been discharged

SOLUS assesses applications individually and deletion is not automatic. If your request is not granted, you can contact the Office for Personal Data Protection.

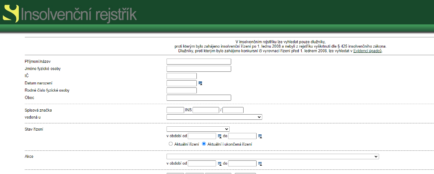

Erasure from the insolvency register

The debtor is removed from the insolvency register, as a rule, 5 years after the legal validity of the decision terminating the proceedings. However, there are exceptions – for example, if the court has dismissed the proceedings, you can apply for removal after 3 months. And if you have resolved your bankruptcy by bankruptcy discharge and have been granted an exemption from paying the rest of your debts by the court, you will “disappear” from the register 3 years after the decision.

Are you solving a similar problem?

Get advice from the experts

Have you been through insolvency and are wondering how to get your name off the register or how to increase your chances of getting a mortgage? Take advantage of our legal advice room, where our experienced attorneys can help you with applications, communication with registers and preparation of documents for banks.

More information

- When you order, you know what you will get and how much it will cost.

- We handle everything online or in person at one of our 6 offices.

- We handle 8 out of 10 requests within 2 working days.

- We have specialists for every field of law.

Can I get a loan after insolvency?

After bankruptcy, a person may finally be free of most of their debts, but their financial history may haunt them for a long time. Even though you have met the terms of the court and your insolvency has been properly discharged, banks and other lenders do not look at your application for a loan, mortgage or other financial product with a clean slate. Logically, they want to make sure that you are now truly able to meet your obligations. However, removal from the debtors’ register after insolvency is not automatic and can take several years. But that doesn’t mean you can’t get a loan after insolvency. Your chances of getting it depend on several factors that can gradually increase your credibility.

1. The length of time since the insolvency ended

One of the key factors that determine your chances of getting a loan after insolvency is time. Most banks will only start looking at you more favourably when at least 2 years have passed since the end of your bankruptcy. Some non-bank companies are willing to lend even sooner, but they usually “compensate” for this in the form of high interest rates. In some cases, you may be lucky even a year after the end of your debt relief, especially if you have an excellent income and no new records.

2. Stable income and work history

Banks nowadays place great emphasis on a regular and provable income. If you have found a stable job or a business after insolvency and you report your income on your tax return, you increase your chances. Having several uninterrupted years in one job or with one client as a self-employed person is very positive.

Banks and non-banking companies also look at your expense-to-income ratio. For example, if you want to take out a long-term loan after insolvency but your income barely covers your rent and basic expenses, it will be very difficult for a lender to trust you.

3. Register of debtors

After the end of the insolvency process, records still remain on debtors’ registers, which is a barrier for many providers. Removal from SOLUS after insolvency is not automatic, the record can remain for up to 3 years after the last liability has been repaid. Bank registers (BRKI and NRKI) also retain information on non-performing loans for up to 4 years after the debt has been repaid. Deletion from the insolvency register is possible 5 years after the end of the insolvency proceedings. Again, however, if you do not file an application, the record may remain longer.

Tip for article

Tip: Can’t keep up with your payments on time? Learn what the law says about debtor default and what the legal consequences are if you don’t pay your debts on time.

Post-insolvency loan: is it legal?

Yes, a post-insolvency loan is possible, but it comes with more stringent conditions. Reputable lenders will require proof of income and a clean record.

If the records persist, a long-term loan after insolvency from specialist non-banking institutions may be the solution. These often operate with a higher level of risk but require, for example, a property or co-signer guarantee.

Getting a mortgage after insolvency is more difficult, but not impossible. Most banks require that at least 3 to 5 years have passed since the insolvency and the client has a clean record. Having a co-borrower with good credit and a high level of equity can help. It is also advisable to approach a mortgage specialist who is familiar with the current approach of banks and knows which institutions have more benevolent conditions for former borrowers.

What to do after insolvency step by step:

- Obtain a discharge order.

- Check the BRKI, NRKI and SOLUS registers.

- File for expungement if possible.

- Wait at least a year before applying for credit.

- Get legal help for more complicated situations.

Summary

After insolvency, many people struggle with the fact that their name remains on the debtors’ registers, making it difficult to get a loan, credit or mortgage. Erasure from the registers (SOLUS, BRKI, NRKI, Insolvency Register) is not automatic and often takes several years – for example, an entry remains in the Insolvency Register for up to 5 years, in SOLUS for 3 years, but it is possible to apply for an earlier erasure. The chances of getting a new loan after insolvency depend on several factors: the longer the time gap since the end of the insolvency (ideally 1-2 years), the better; a stable and verifiable income, employment history and the absence of new negative entries in the registers are also key. A real estate guarantee or a co-applicant with a clean credit record is also an option. Some non-bank companies provide loans after insolvency, but often with high interest rates and risky conditions, so you need to be cautious. If you are interested in a mortgage, you should allow for an even longer gap (3-5 years) and ideally contact a mortgage specialist. Step by step, after the end of the debt relief, it is advisable to: obtain a court decision, check the registers, apply for deletion, wait at least a year and, if necessary, take professional legal advice.